The One Big Beautiful Bill Act was signed into law on July 4th, introducing a number of tax changes and financial planning considerations to be aware of. In this month’s edition of “Sound Financial Planning Tee to Green,” we will review five financial planning changes to be aware of with the new tax laws in effect.

Current Tax Rates Permanently Extended

The Tax Cuts and Jobs Act (TCJA) of 2017 lowered many of the tax bracket income thresholds and rates to historically low levels. These brackets were set to sunset at the end of 2025, back to the pre-TCJA rates, adjusted for inflation.

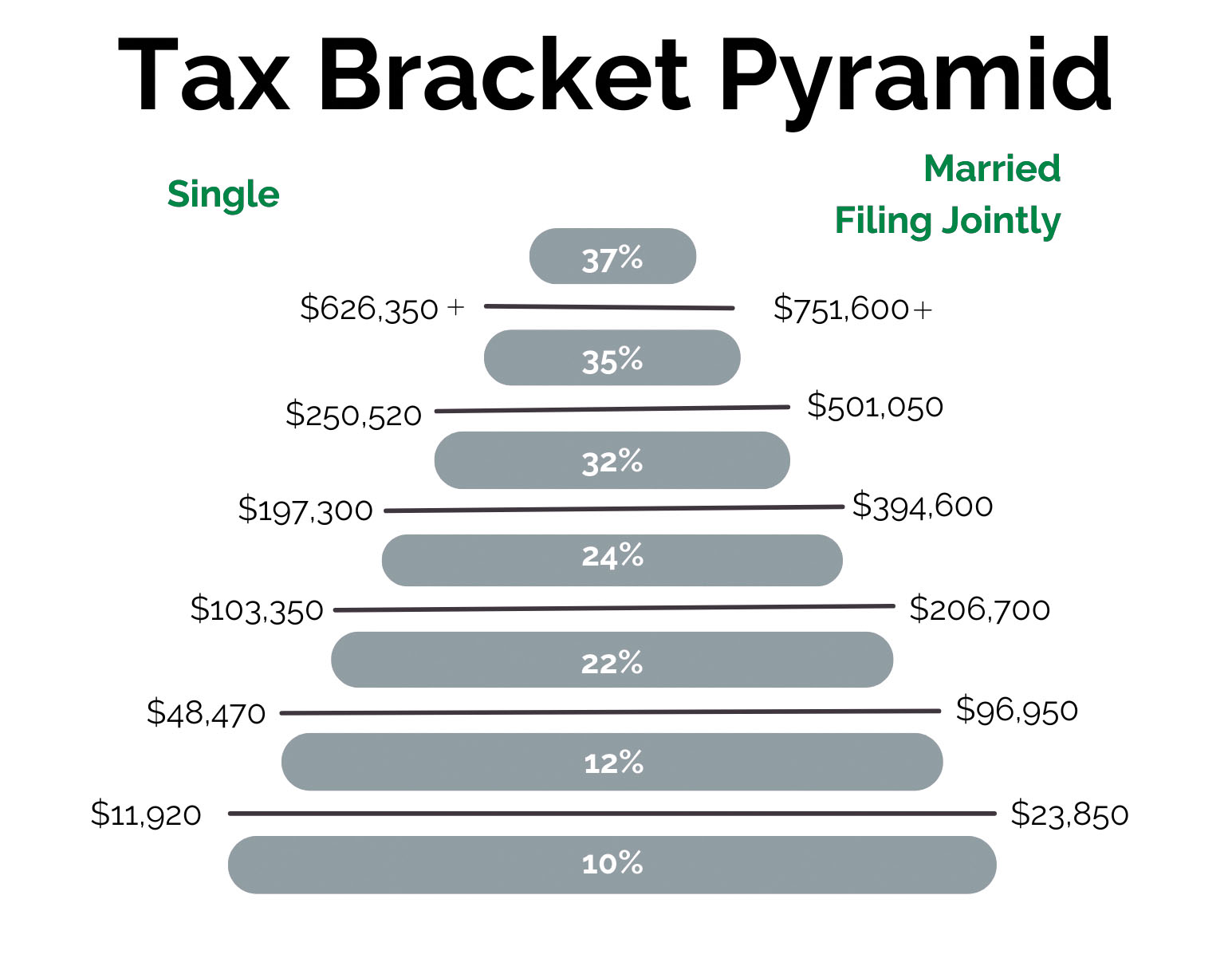

The One Big Beautiful Bill permanently extends the existing rates, providing an opportunity to realize income at lower tax rates than we’ve historically been able to. The 2025 tax rates are below:

Changes to the Standard Deduction and Itemized Deductions

The standard deduction for 2025 was originally $30,000 for married filing jointly (MFJ) and $15,000 for single. The tax bill has retroactively changed the standard deduction to $31,500 from MFJ and $15,750 for single.

The State and Local Tax (SALT) deduction has been limited to $10,000 regardless of filing status since the TCJA. These taxes include property taxes and sales taxes for individuals in states like Texas.

The new tax bill increases this limit to $40,000 from 2025 to 2029 for those under the phaseout range. This deduction is phased back down to $10,000 for filers with a modified adjusted gross income between $500,000 and $600,000.

Notably, this means that an increase in modified adjusted gross income from $500,000 to $600,000 could increase your taxable income by $130,000 after factoring in the reduced SALT deduction.

New Opportunity to Deduct Charitable Contributions

Historically, in order to receive a tax benefit for charitable contributions, a filer must itemize their deductions.

The new tax bill has introduced a new opportunity to give up to $2,000 if married filing jointly ($1,000 if single) and deduct this contribution without itemizing, beginning in 2026. This presents a potential opportunity for certain individuals to strategically give a large amount in a high-income year, called a bunching strategy, using a vehicle like a donor-advised fund and giving the deductible $2,000 in years that the standard deduction will be taken.

New Planning Considerations for Seniors

The new bonus deduction for seniors was introduced with the goal of offsetting some of the taxes owed for Social Security benefits. This deduction is available beginning in 2025 through 2028 for anyone turning 65 or older in the given tax year, regardless of Social Security filing status.

This bonus deduction begins to be phased out at $150,000 of modified adjusted gross income for married couples ($75,000 for single) and is fully phased out for MAGI above $250,000 for married couples ($175,000 for single).

This will be an important consideration for retirees looking to complete Roth conversions and may provide justification to complete charitable contributions from IRAs as a qualified charitable distribution to reduce required minimum distributions.

529 Funds Continue to Become More Flexible

The growing trend for 529 plans has been additional flexibility for funds not needed for college expenses. That trend continues with the latest tax bill.

The new bill will allow for an increased withdrawal limit of $20,000 per beneficiary for K-12 expenses, up from $10,000, beginning in 2026.

At present, only tuition is an eligible expense for K-12 reimbursement. In addition to the increased withdrawal limit, qualifying expenses will include additional items such as curriculum materials, books, online education resources, tutoring and standardized test fees.

If you are interested in finding out more about these options, check out our podcast, Cup of Bull (www.cupofbull.com), where we dive deeper into the options.

Michael Dunham, CFP® is the Director of Planning at Fontana Financial Planning. For more financial planning information, visit www.cupofbull.com or call 214-400-1001. Michael Dunham, CFP® earned his BBA at The University of Missouri and completed his CFP® at SMU. For financial planning inquiries, email team@fontanafinancial.com or call 214-400-1001. Fontana Financial Planning is located at 12240 Inwood Rd., Suite 450, Dallas, Tx 75244.